All Categories

Featured

Table of Contents

- – Best-In-Class Accredited Investor Growth Oppor...

- – Accredited Investor Secured Investment Opportu...

- – Best Private Placements For Accredited Investors

- – Best-In-Class Accredited Investor Opportuniti...

- – Tailored Accredited Investor Crowdfunding Op...

- – Award-Winning Exclusive Deals For Accredited...

- – Accredited Investor Alternative Investment D...

The guidelines for certified capitalists differ among jurisdictions. In the U.S, the meaning of an approved financier is put forth by the SEC in Policy 501 of Law D. To be an accredited financier, a person needs to have an annual earnings going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the assumption of making the very same or a greater income in the present year.

This amount can not include a primary residence., executive policemans, or supervisors of a company that is issuing non listed securities.

Best-In-Class Accredited Investor Growth Opportunities with High-Yield Investments

Also, if an entity consists of equity owners that are certified capitalists, the entity itself is a recognized capitalist. A company can not be developed with the single purpose of purchasing particular safety and securities. An individual can certify as an accredited financier by demonstrating enough education or task experience in the economic industry

Individuals who desire to be recognized investors do not put on the SEC for the designation. Instead, it is the responsibility of the business using a personal placement to see to it that all of those come close to are accredited financiers. People or celebrations that want to be recognized financiers can approach the provider of the non listed securities.

Expect there is an individual whose earnings was $150,000 for the last three years. They reported a key residence worth of $1 million (with a home loan of $200,000), a vehicle worth $100,000 (with an outstanding lending of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Web well worth is determined as properties minus obligations. He or she's web well worth is exactly $1 million. This entails an estimation of their assets (besides their main house) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan equating to $50,000. Because they satisfy the total assets demand, they certify to be a recognized capitalist.

Accredited Investor Secured Investment Opportunities

There are a few less typical qualifications, such as handling a trust fund with greater than $5 million in assets. Under government protections regulations, just those who are recognized capitalists may join specific protections offerings. These might include shares in personal placements, structured items, and private equity or bush funds, amongst others.

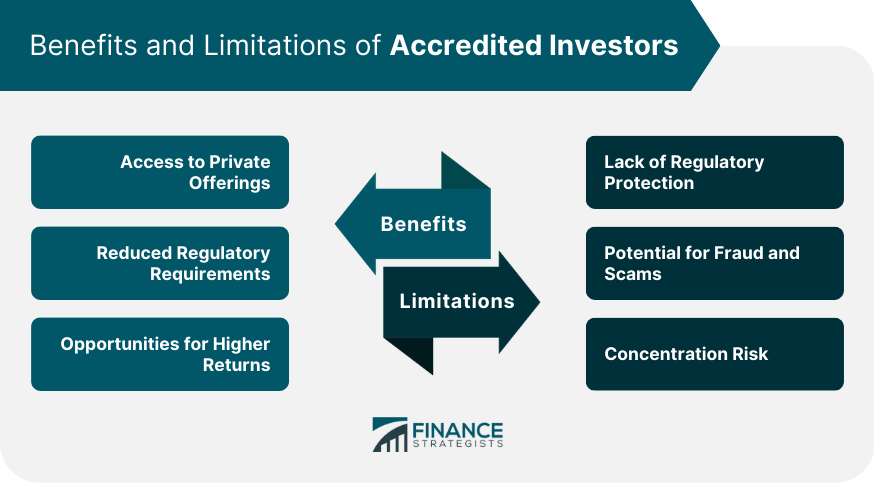

The regulators wish to be particular that individuals in these highly risky and complex investments can fend for themselves and evaluate the risks in the lack of federal government security. The certified financier guidelines are developed to secure prospective financiers with limited economic understanding from adventures and losses they might be ill outfitted to endure.

Certified investors fulfill credentials and expert requirements to access unique financial investment opportunities. Approved investors need to fulfill revenue and internet worth needs, unlike non-accredited people, and can invest without restrictions.

Best Private Placements For Accredited Investors

Some essential modifications made in 2020 by the SEC include:. Consisting of the Collection 7 Collection 65, and Collection 82 licenses or other credentials that show financial proficiency. This adjustment recognizes that these entity types are typically made use of for making investments. This adjustment recognizes the proficiency that these staff members establish.

These changes broaden the recognized investor swimming pool by approximately 64 million Americans. This bigger gain access to gives more possibilities for investors, yet likewise raises possible dangers as much less monetarily advanced, investors can participate.

These financial investment choices are special to certified financiers and organizations that qualify as a certified, per SEC laws. This provides accredited financiers the chance to invest in arising firms at a phase prior to they think about going public.

Best-In-Class Accredited Investor Opportunities with High-Yield Investments

They are watched as financial investments and are easily accessible just, to qualified clients. In addition to recognized companies, certified investors can select to invest in start-ups and up-and-coming endeavors. This supplies them tax obligation returns and the possibility to enter at an earlier phase and potentially enjoy benefits if the business prospers.

Nonetheless, for financiers open to the dangers included, backing start-ups can cause gains. Most of today's technology companies such as Facebook, Uber and Airbnb stemmed as early-stage startups supported by certified angel financiers. Innovative financiers have the chance to explore investment choices that may yield extra profits than what public markets use

Tailored Accredited Investor Crowdfunding Opportunities

Although returns are not assured, diversification and portfolio enhancement options are expanded for financiers. By expanding their profiles via these expanded investment opportunities approved capitalists can enhance their approaches and possibly achieve premium long-lasting returns with correct danger monitoring. Skilled investors often experience investment choices that might not be quickly readily available to the basic capitalist.

Financial investment alternatives and safety and securities provided to certified capitalists usually involve higher threats. Personal equity, endeavor capital and bush funds often concentrate on investing in possessions that bring risk but can be sold off easily for the possibility of better returns on those high-risk investments. Looking into prior to investing is critical these in scenarios.

Lock up durations protect against financiers from withdrawing funds for even more months and years on end. Capitalists may struggle to properly value private possessions.

Award-Winning Exclusive Deals For Accredited Investors

This modification might expand certified capitalist condition to a variety of people. Allowing companions in fully commited connections to integrate their sources for common qualification as recognized capitalists.

Making it possible for individuals with certain specialist qualifications, such as Collection 7 or CFA, to certify as accredited investors. This would certainly recognize monetary sophistication. Creating extra requirements such as evidence of financial literacy or effectively finishing a recognized capitalist exam. This can guarantee investors recognize the dangers. Limiting or eliminating the key house from the total assets computation to lower possibly filled with air evaluations of wide range.

On the various other hand, it might likewise result in knowledgeable investors assuming excessive dangers that may not be suitable for them. Existing certified financiers may deal with boosted competitors for the ideal financial investment opportunities if the swimming pool expands.

Accredited Investor Alternative Investment Deals

Those that are currently taken into consideration accredited investors have to remain updated on any kind of alterations to the standards and laws. Their qualification might be subject to alterations in the future. To preserve their standing as recognized investors under a changed interpretation adjustments might be needed in wealth management strategies. Businesses looking for recognized capitalists ought to stay vigilant about these updates to ensure they are attracting the right audience of financiers.

Table of Contents

- – Best-In-Class Accredited Investor Growth Oppor...

- – Accredited Investor Secured Investment Opportu...

- – Best Private Placements For Accredited Investors

- – Best-In-Class Accredited Investor Opportuniti...

- – Tailored Accredited Investor Crowdfunding Op...

- – Award-Winning Exclusive Deals For Accredited...

- – Accredited Investor Alternative Investment D...

Latest Posts

Tax Foreclosed Home

Tax Lien Certificates Investing

Tax Default Properties Near Me

More

Latest Posts

Tax Foreclosed Home

Tax Lien Certificates Investing

Tax Default Properties Near Me